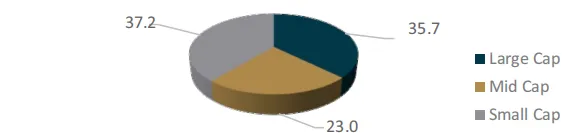

Investment Approach Objective: To invest predominantly in a few concentrated themes / sectors at a time – wherein structural transformation is underway, by constructing a portfolio of businesses across a range of market capitalizations.

| Syrma Sgs Technology Ltd | 5.1 |

| Adani Ports & Special Economic Zone Ltd | 5.0 |

| Elecon Engineering Company Ltd | 5.0 |

| Hindustan Aeronautics Ltd | 4.7 |

| Ambuja Cements Ltd | 4.5 |

| Gravita India Ltd | 4.5 |

| Dixon Technologies India Ltd | 4.2 |

| Power Mech Projects Ltd | 4.1 |

| Interglobe Aviation Ltd | 4.0 |

| Adani Energy Solutions Ltd | 3.9 |

| Capital Goods | 41.7 |

| Services | 9.0 |

| Consumer Durables | 8.2 |

| Construction | 6.9 |

| Construction Materials | 4.5 |

| Metals & Mining | 4.5 |

| Power | 3.9 |

| Automobile and Auto Components | 3.8 |

| Total Assets under Management & Advisory in Rs. Crs. | 498 |

| Weighted Average Market Cap in Rs. Crs. | 98,148 |

| Median Market Cap in Rs. Crs. | 61,904 |

In Q4FY25 results of portfolio companies declared so far, the operating performance of Adani Energy was largely in-line with estimates. Elecon Engineering’s revenues were better than estimates. IOC and Transformers & Rectifiers beat estimates led by higher margins. Ambuja Cements’ results were ahead of expectations led by better cost management.

On the portfolio performance front, the key underperformers during the month were Ramkrishna Forgings, Blue Star, Amber Enterprises, Transformers & Rectifiers and Titagarh Rail, while the key outperformers during the month were Dixon Technologies, Elecon Engineering, Solar Industries, Mazagon Dock and IOC.

During the month, we partially booked profits in Bharat Electronics, Mazagon Dock and Solar Industries.